Your guide to MTD for Income Tax

Pier View Accounting provides ongoing support and digital expertise for individuals and businesses transitioning to the new Making Tax Digital (MTD) initiative for Income Tax. We’ve outlined what you need to know about transferring to digital records, delivering quarterly reporting, and finding the best MTD software.

Contents

What is Making Tax Digital?

Making Tax Digital (MTD) is a government initiative to change how self-employed people report their income to HM Revenue & Customs (HMRC). If you’re self-employed or a landlord, MTD for Income Tax Self-Assessment (ITSA) applies to you from April 2026. You will need to set up MTD accounting software which will report your income periodically throughout the year, rather than filing one annual tax return.

HMRC have an online tool for individuals to check if they need to use MTD for income tax

This guide should help you to understand your legal obligations, and how you can get prepared for MTD for Income Tax well ahead of April 2026. Our digital experts at Pier View Accounting are here to help you feel confident with digital accounting, and set everything up for you in advance of the changeover date.

Understanding MTD for Income Tax

If you’re self-employed, or a landlord with property income, MTD for ITSA will be rolled out in phases, depending on your annual qualifying income:

From April 2026

MTD for ITSA will apply if you are a sole trader or landlords with a gross income of over £50,000 per annum.

From April 2027

MTD for ITSA will apply if you have a gross income of over £30,000 per annum.

From April 2028

HMRC plans to roll out MTD for ITSA further to include those with a gross income of over £20,000 per annum.

After 2028

HMRC are still considering whether those earning below £20,000 will be subject to MTD for ITSA in the future.

If you don’t know where your income falls under this roll-out plan, we can go through your financial records to understand when you’ll be required to set up MTD accounting software.

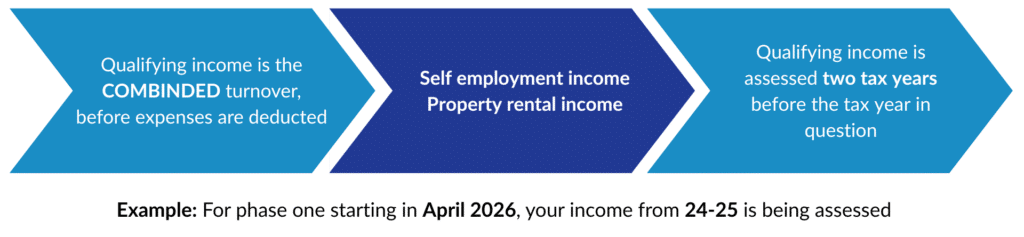

What is "Qualifying Income"

“Qualifying Income” is income generated by

- Self-employment (sole trader turnover)

- Property rental income (before deducting any expenses).

This is before subtracting any allowable business expenses, personal allowances or any tax relief.

You do not include:

- Pensions

- Savings Interest

- Dividend income

- PAYE income

These are included in your annual self-assessment.

Your “Qualifying Income” to determine if you should be submitting quarterly reports is assessed two tax years before the tax year in question. For April 2026 this will be based on the 2024-2025 tax year.

Get your business ready for MTD with expert accountancy in Clevedon & Bristol

MTD for ITSA has been rolled out to improve tax reporting in the UK through three main changes. The initiative has been designed to help individuals and businesses monitor their finances and tax obligations throughout the year, as well as reducing the errors that come from manually uploading an annual tax return.

Digital and visible:

While the initial upload of paper records and data transfer from other databases may seem like a headache, once the MTD accounting software is set up, you’ll have clear oversight of your finances, and a consistent way to manage income and expenses moving forward.

Regular updates and reports:

Every quarter, you’ll share summary updates of your income and expenses to HMRC through your MTD accounting software. Once we show you how to set everything up, submitting your digital tax through us will be as simple as the click of a button.

Final declarations:

At the end of the tax year, you also need to share an End of Period Statement (EOPS) for each business/property source, and a final declaration for all your income (including any non-MTD income like employment or investment income), which allows HMRC to calculate how much tax you owe overall.

MTD accounting software:

There are a wide variety of MTD-compliant software packages including Sage, QuickBooks, Xero, and FreeAgent. At Pier View Accounting, we are a “Sage for Accountants Certified Client Advisor” , so we can give you certified expertise with this software, but if you’ve MTD accounting software you prefer, our digital experts can work with any software you’ve chosen for your business.

We’ll help you understand exactly what you need to do and when

Transitioning to a cloud-based accounting system which produces automated reports can make you feel like you’ve lost control, especially if you’ve been used to doing it all yourself. It takes a lot of trust that the software will get it right every time, but these systems have been designed to improve efficiency, and reduce human errors. Our experts are on hand to make sure you choose the right software for your business, and help you feel confident that it will improve and not hinder your financial reporting.

Why you need to go digital

We’ll help you understand what you need to do to be compliant with MTD for ITSA, and by when, depending on your annual income bracket. We’ll walk you through every step of the process to make your business accounting stress-free.

Which software is best for you

We can help you choose the best MTD accounting software for your business, show you how it works, and get you feeling confident with it. We’re Sage Accounting specialists, so we can sing its praises, but if another software suits you better, we’ll help with that too.

The process of going digital

We’ll get all of your paper records, spreadsheets, and data from other sources uploaded accurately, and connect your bank accounts so you always have access to the latest and most accurate information.

Managing your financial reports

We can show you how to produce accurate financial reports, and submit your own quarterly submissions on time using the software. Or if you’d prefer, we can do all the reporting and submissions for you.

EOPS and your final declaration

Our team can work with you to submit your end-of-year statements and final tax declaration, making sure that all of your incomes are reported accurately, through the right channels, or in the right reports, and any allowable expenses are claimed.

Peace of mind

We’ll be on hand to provide digital support whenever you need, make sure you’re taking advantage of the latest features, and that you’re continuing to feel confident using the software you’ve chosen.

Useful resources for MTD from HMRC

Get ready for MTD with Pier View Accounting

Pier View Accounting is here to make your transition to digital accounting pain-free and stress-free. Our experts can answer any questions before you commit to setting up your online business accounting software of choice as we want you to be confident in the software, and in our team.

If you want more information about your MTD obligations, or you want support with transitioning to a digital accounting system, contact us today for a chat about how we can help you digitise your accounts and get compliant in time for MTD in April 2026.